Trade-Based Laundering, Complicit Vendors, and Where the Invoices Hide

When you think of cartels, you imagine drugs and guns. What you’re missing is the plumbing — the invisible arteries that keep the profits flowing. Trade-based schemes, fake invoices, and compliant vendors are what make the cartels unstoppable. Without understanding those mechanics, you keep fighting symptoms while the disease multiplies.

The Mechanics of Laundering by Trade

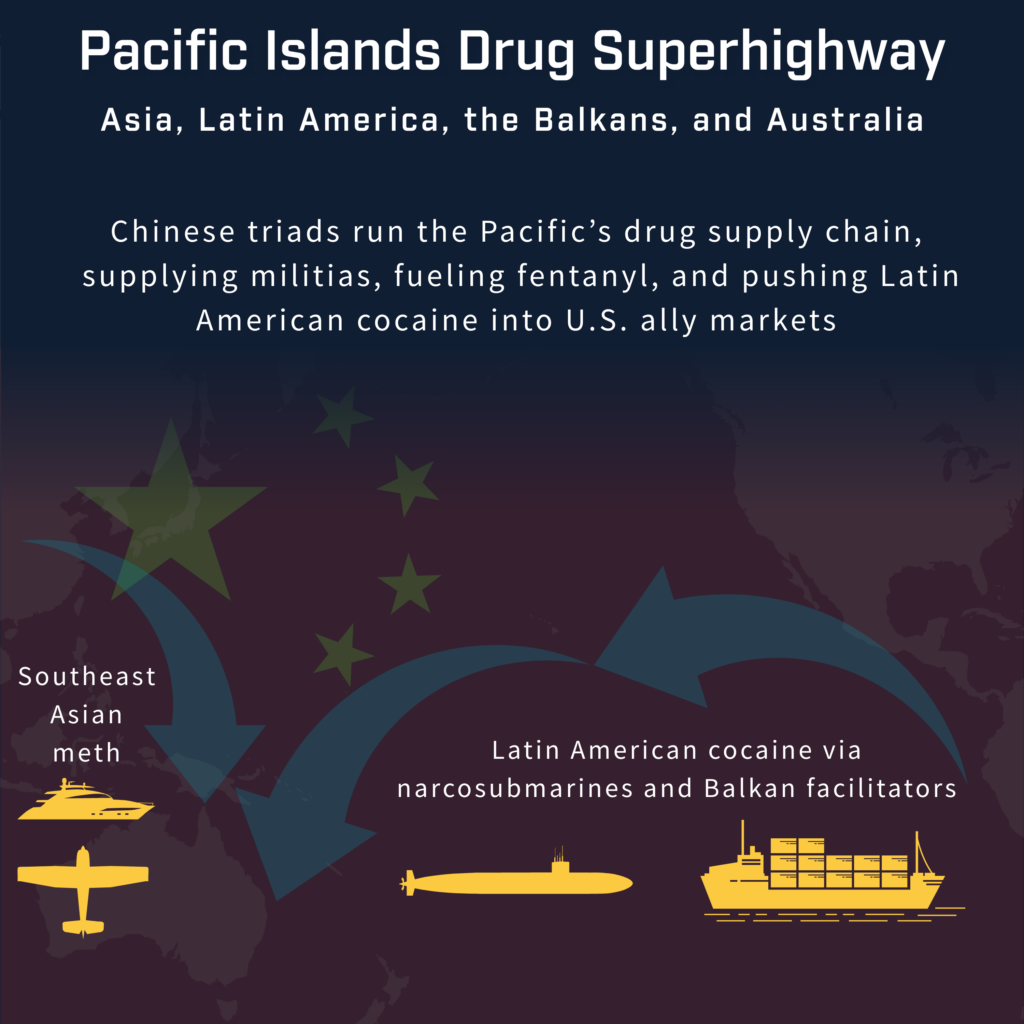

Cartels exploit the fact that global commerce expects goods to move across borders — so fake invoices become the camouflage. Money travels disguised as electronics, commodities, or luxury goods. Chinese counterparties buy products from U.S. ghost firms; cash flows back through layered intermediaries to Mexican networks.

Formal financial institutions are not immune. This year, the U.S. Treasury and FinCEN named three Mexico-based institutions — CIBanco, Intercam Banco, and Vector Casa de Bolsa — as “primary money-laundering concerns” for facilitating cartel payments and chemical precursor imports.

Meanwhile, small import-export vendors handle the grunt work. Goods are shipped with inflated values on “triangle routes,” where items are exported through multiple intermediaries to mask their true destination. Many of these companies have no production footprint, yet record millions in exports.

Complicit Vendors & Shell Ecosystems

Picture a border warehouse where a cartel drops cash, and a front company ships out air conditioners to China. The paper trail shows a legal sale; the cash returns to the cartel’s pockets. Freight forwarders and warehouse operators become unwitting partners — or willing ones — and pass quietly under compliance radar because everything looks legitimate on paper.

In Texas, black-market peso exchange schemes used retail store owners to accept cash, ship goods to Mexico, and convert proceeds into commodities. Elsewhere, U.S. intermediaries withdrew hundreds of thousands in small increments, deposited at ATMs, and converted them into cashier’s checks or crypto before wires disappeared offshore.

Why This Matters

The scale is staggering. Trade-based laundering now moves tens of billions annually through false invoicing and commodity trades. Cartels have moved beyond bribing politicians; they’ve co-opted entire segments of the legal economy. And regulators still chase yesterday’s patterns — wire transfers and cash smurfing — while the money rides in shipping containers.

Focus Areas for Disruption

- Invoice analytics: Identify firms that export high-value goods without labor, inventory, or production overhead.

- Freight-forwarder mapping: Reconstruct routes behind shell companies and low-volume exporters.

- Cross-border bank flows: Track wire clusters connecting Mexican and Chinese intermediaries with import-export shells.

- Corporate transparency: Mandate beneficial-owner reporting and tie customs data to banking disclosures.

The fight against money laundering isn’t about catching bagmen — it’s about understanding logistics. The cartels don’t hide the money in barrels anymore; they hide it in paperwork.

Citations

- GTR Review – “US fires warning over Mexican cartels, Chinese money-laundering networks” (September 3, 2025)

- U.S. Treasury – “Treasury Issues Historic Orders under Powerful New Authority” (June 25, 2025)

- FINRA – “Treasury Names Three Mexico-Based Financial Institutions as a Primary Money Laundering Concern” (August 20, 2025)

- TRM Labs – “FinCEN Targets Three Mexico-Based Financial Institutions for Laundering Opioid Proceeds” (June 26, 2025)

- The Guardian – “Mexican president demands proof after US accuses banks of laundering drug money” (June 26, 2025)

- Laredo Morning Times – “Two sentenced for roles in black-market peso exchange money-laundering scheme” (July 22, 2025)

- Reuters – “US bans certain deals with two Mexican banks, broker under fentanyl sanctions” (June 25, 2025)

Pingback: The Woman Who Filed America - #TCOT Reporter